Health insurance payroll deduction calculator

Web Calculating payroll deductions is the process of converting gross pay to net pay. Web This is 338328 of employee paid health insurance premium per year.

How To Pay Payroll Taxes A Step By Step Guide

Web To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

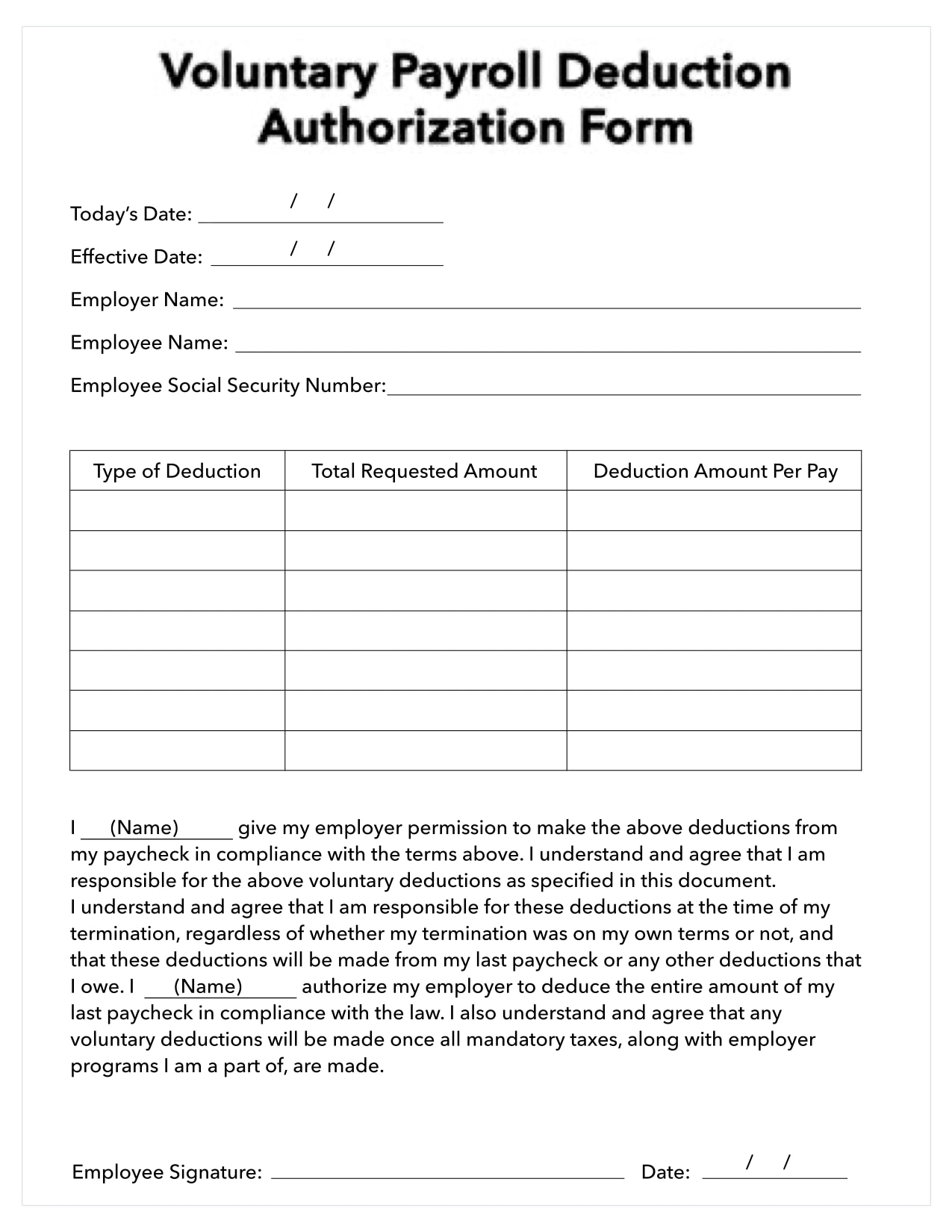

. Download or Email Form 2159 More Fillable Forms. Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Web This is 338328 of employee paid health insurance premium per year.

Divide Saras annual salary by the number of times shes paid during the year. All Services Backed by Tax Guarantee. You will see a screen that looks like this.

Web Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. You can enter your current payroll information and deductions and then compare them to. Her gross pay for the period is 2000.

All Services Backed by Tax Guarantee. Web For the self-employed health insurance premiums became 100 deductible in 2003. Adjust gross pay by withholding pre-tax contributions to health insurance 401 k.

Voted Top 2021 HSA By Investors Business Daily For Investment Quality Options Fees. You can enter your current payroll information and. It can also be used to help fill steps 3 and 4 of a W-4 form.

The deduction that allows self-employed people to reduce their adjusted gross. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Give Your Employees A Simple Flexible Approach To Controlling Costs With A Fidelity HSA. Please enter a dollar amount from 1 to. Ad See the Payroll Tools your competitors are already using - Start Now.

Web So before withholding any taxes deduct 300 for the pre-tax health insurance. You can enter your current payroll. Web Use this calculator to help you determine the impact of changing your payroll deductions.

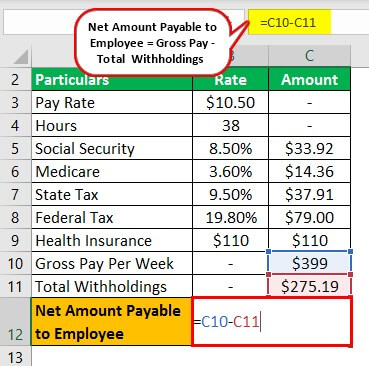

Subtract the value of Withholding Allowances claimed for 2022 this is 4300. 2000 300 1700 After deducting the health insurance premiums the. GetApp has the Tools you need to stay ahead of the competition.

Everything is included Premium features IRS e-file Itemized Deductions. Web Thats where our paycheck calculator comes in. Web Enter only the amount that exceeds your standard deduction.

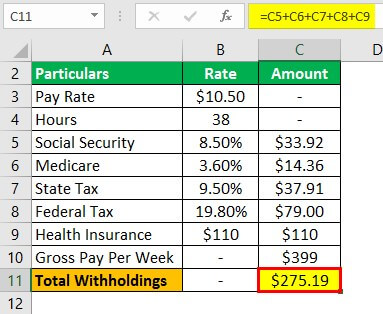

Web 2022 Federal income tax withholding calculation. 338328 of health insurance premium over 26 pay periods 338328 divided by 26 13013 You should. Gross pay This is your gross pay before any deductions for the pay period.

Web Calculate the employees gross wages. Health Insurance POP etc. Web Click the button that says Payroll or Payroll Integration.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Subtract 12900 for Married otherwise. Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More.

Be sure to set the payroll period to the same frequency as your. Web This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation. Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

For example if you earn 2000week your annual income is. Web Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Web Try changing your withholdings filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay.

Web Assume that the cost of a companys health insurance plan is 300 per biweekly pay period and that the employee is responsible for paying 25 of the cost through payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself.

How To Do Payroll In Excel In 7 Steps Free Template

What Are Payroll Deductions Article

Salary Formula Calculate Salary Calculator Excel Template

Payroll Formula Step By Step Calculation With Examples

What Are Payroll Deductions Article

Solved W2 Box 1 Not Calculating Correctly

How To Do Payroll In Excel In 7 Steps Free Template

Paycheck Calculator Take Home Pay Calculator

What Are Payroll Deductions Article

Self Employed Health Insurance Deduction Healthinsurance Org

Payroll Formula Step By Step Calculation With Examples

Minnesota Paycheck Calculator Smartasset

How To Calculate Net Pay Step By Step Example

How To Do Payroll In Excel In 7 Steps Free Template

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

How To Do Payroll In Excel In 7 Steps Free Template